Private equity and finance

Firms trust Xapien as their first line of defence

Investors, deals, and opportunities are left waiting while compliance teams seek answers to more nuanced questions.

Increasing scrutiny from consumers, investors and the regulator means this friction could intensify. Compliance teams now need to decide if they "should" proceed with an investment on an ethical basis. This requires deep contextual research, which is a slow and painstaking process.

Your reputation rests on the depth of your due diligence.

The regulator, consumers, and investors expect thorough due diligence on every client and deal, leaving no stone unturned. Relying on traditional databases and surface-level internet searches isn't enough to answer these broader questions. However, full-scale internet research costs time and money... until now.

Remove barriers to increase deal velocity

“Xapien is our first line of defence to catch risks early in the process."

Head of Compliance from a leading private equity firm.

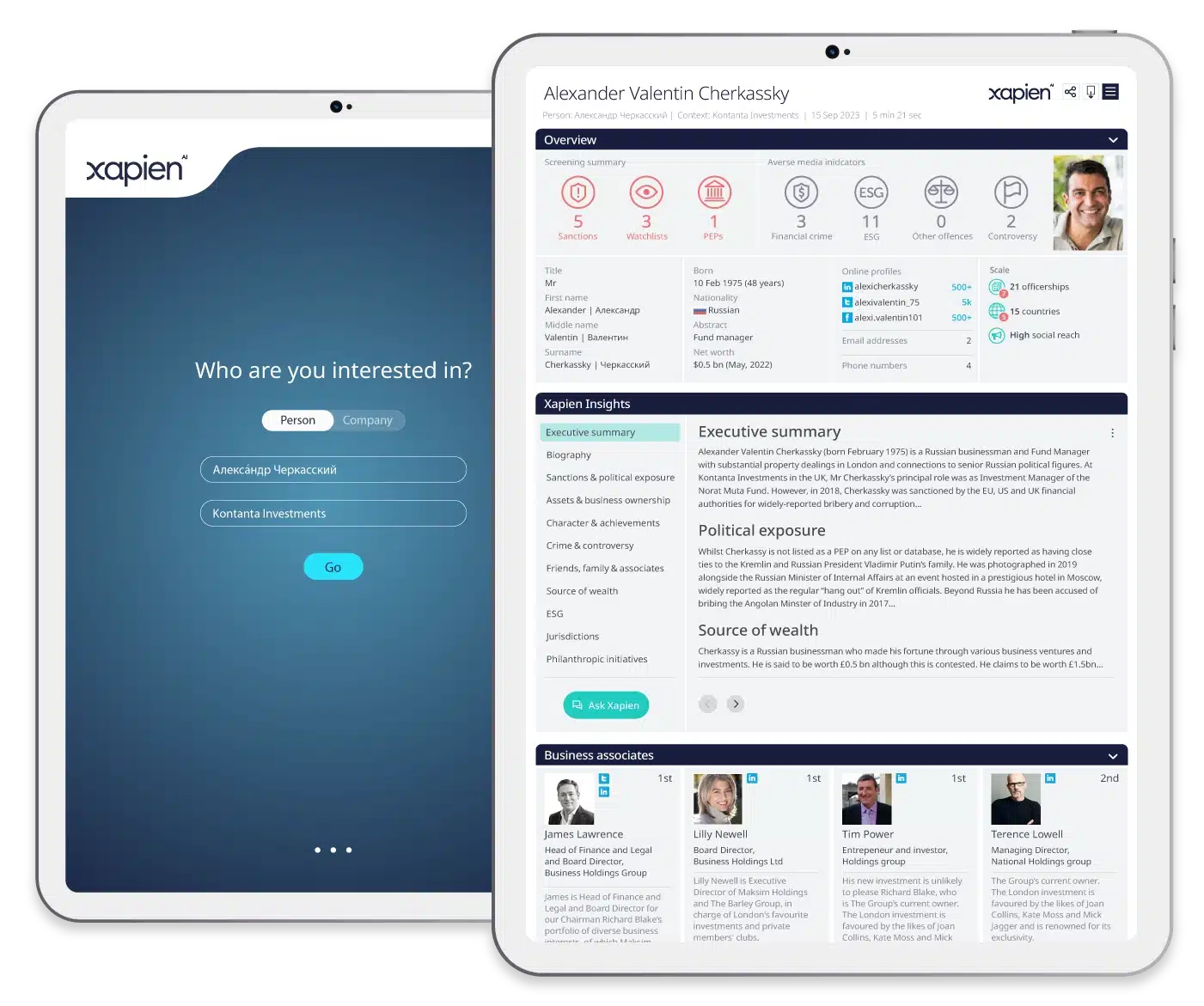

Xapien is an AI-powered research platform that fulfills AML and KYC checks and delivers deep contextual research on any individual or organisation in the world in minutes. It provides nuance, at speed.

Xapien integrates data from 0.5 billion corporate records, PEPs, sanctions, and watchlist screening datasets, and information from the entire indexed internet. Concisely written summaries enable compliance teams to answer deal teams in minutes, not days.

Designed with firms in mind

90+

Customers are using our platform

50,000+

Hours are saved on average

Trusted by world-leading institutions.

How Xapien works... in 30 seconds

Ready to get started?

Get in touch with our team